Selling Your Home?

06/21/2022

Overview

With the recent surge in the residential real estate markets, homeowners may be considering selling their residence. Homeowners should be aware of the potential tax implications, as the gain realized on a sale in today’s market could be significant.

Section 121 of the Internal Revenue Code allows homeowners to exclude gains on the sale of their principal residence. Unmarried taxpayers can exclude gains up to $250,000 and married taxpayers can exclude gains up to $500,000.

To take full advantage of the principal residence gain exclusion break, you must meet certain criteria.

- Ownership test- you must have owned the home for at least two years out of the five-year period ending on the sale date.

- Use test- you must have used the home as your principal residence for at least two years out of the five-year period ending on the sale date.

- You did not exclude an earlier gain within the two-year period ending on the date of the later sale. You generally cannot take the gain exclusion until two years have passed since you last used it.

How it works:

In its most basic form, the exclusion works like this:

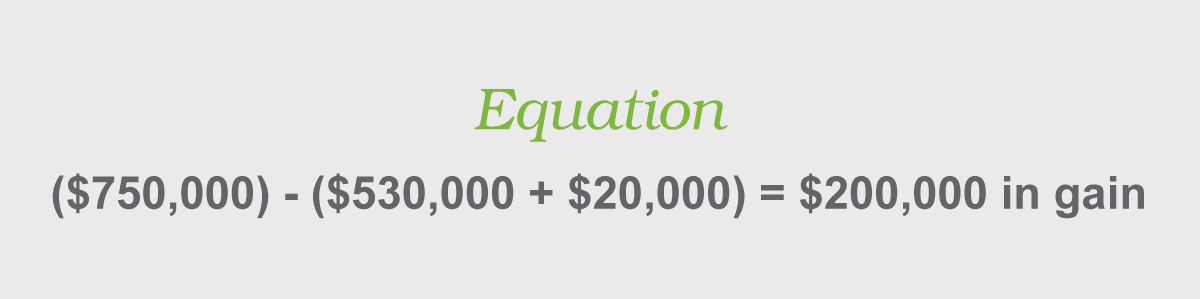

Example: John Smith, a single taxpayer, purchased a home as his principal residence for $530,000 on June 3, 2015. He resided in the house the entire time and spent $20,000 improving the home. On July 15, 2021, John Smith sold the home for $750,000, recognizing $200,000 in gain.

Because John Smith owned and used the home as his principal residence for at least two of the five years prior to July 15, 2021, John Smith may exclude up to $250,000 of gain. Thus, John Smith may exclude the entire $200,000 gain. This is how the gain exclusion works in its simplest form, but just like many sections in the Code there are exceptions and other items to consider.

HiAccounting Tax Experts Can Help You Navigate This Opportunity!

Considering selling your home? Our tax experts at Hawaii Accounting can help you navigate the sale of your principal residence home to ensure you are able to maximize your tax savings. Our CPAs and business advisors have many years of experience with these transactions and can make sure you don’t miss out on this important tax opportunity!

Ready To Talk About Your Tax Needs?

We provide a free call to learn more about you and your needs, to identify all tax savings opportunities. Call us today at 808.529.9990!

Get In Touch

HiAccounting would be pleased to get in touch to discuss your accounting needs.

By submitting this form and signing up for texts, you consent to receive text messages from HiAccounting at the number provided. Msg data rates may apply. You can opt-out at any time.

Locations

Maui Office

24 N Church StreetWailuku, HI 96793

Phone 808.356.4357

Oahu Office

700 Bishop St. Suite 600Honolulu, Hi 96813

Phone 808.529.9990

Hilo Office

145 Keawe StHilo, HI 96720

Phone 808.529.9990

Office Hours

Monday - Friday8:00am - 5:00pm

Closed on Holidays