Hawaii's General Excise Tax (GET)

03/11/2020

Is Hawaii’s General Excise Tax (GET) a sales tax?

In short, No. Hawaii does not have a sales tax. The GET is different from a sales tax because:

(1) A sales tax is a tax on customers whereas GET is a tax on businesses; and

(2) Businesses are required to collect sales tax from their customers whereas businesses are not required to collect GET from their customers.

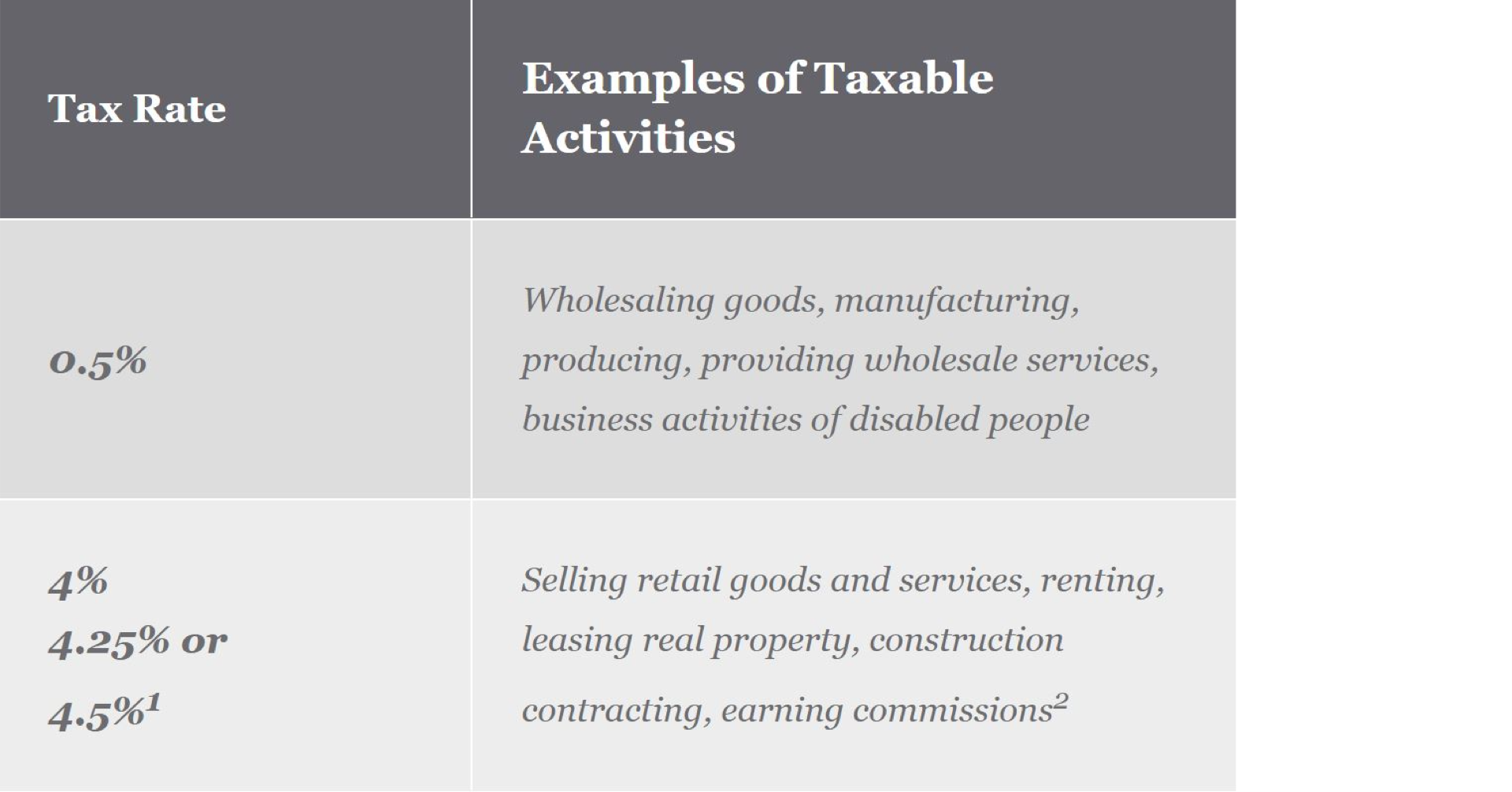

What are the GET rates for businesses?

1 The 4% rate applies statewide except in a county where the tax rate includes a 0.25% or 0.5% county surcharge for a total tax rate of 4.25% or 4.5%. The county surcharge does not apply to activities taxed at the 0.5% rate (for example, selling wholesale goods) or activities sourced outside a county with a surcharge. (Note: This is not a complete list of tax rates and activities.)

2 Except for insurance commissions, which are taxed at 0.15%.

Are businesses required to charge GET?

No. It is common for businesses to charge their customers GET by visibly passing it on, but it is not required by law. Businesses must pay GET whether or not they charge their customers for it. In certain circumstances, the law prohibits businesses from charging additional fees or amounts including GET.

What is the difference between the GET and use tax?

The GET and use tax are complementary taxes. This means that a sale will be subject to either the GET or use tax, but not both taxes.

If you are doing business in Hawaii, then you are required to obtain a GET license. The GET is imposed on a licensed seller’s gross income from doing business in Hawaii. Since the sales of a licensed seller are subject to GET, customers (purchasers) are not subject to the use tax. The licensed seller is responsible for reporting and paying GET to the Department of Taxation (Department). Businesses are subject to the GET on their sales to customers and may also be subject to the use tax at the time of import if the same product, service, or contracting was purchased from an unlicensed out-of-state seller.

If you are not doing business in Hawaii, then you are not required to obtain a GET license. Instead of GET, use tax is imposed on a customer who purchases and imports for use in Hawaii goods, services, and contracting from an unlicensed seller located outside the state. Since the sales of an unlicensed seller are not subject to GET, the customer is subject to the use tax. The customer (purchaser) is responsible for reporting and paying use tax to the Department.

What is the due date for filing an annual GET return?

The due date is the 20th day of the fourth month following the close of the taxable year. For calendar year filers, the due date is April 20th of the following year.

HiAccounting can make sure you have your bases covered. Call the Experts!

Hawaii’s General Excise Tax has its nuances and can be less straightforward than a business owner may hope, especially in sectors with additional technicalities. Our tax practice has many years of experience successfully navigating opportunities and mitigating liabilities for companies. With our experience, you can be assured that your business is fully compliant! Call us today at 808.529.9990!

For more information you can view the State’s website at: https://tax.hawaii.gov/geninfo/get/

Get In Touch

HiAccounting would be pleased to get in touch to discuss your accounting needs.

By submitting this form and signing up for texts, you consent to receive text messages from HiAccounting at the number provided. Msg data rates may apply. You can opt-out at any time.

Locations

Maui Office

24 N Church StreetWailuku, HI 96793

Phone 808.356.4357

Oahu Office

700 Bishop St. Suite 600Honolulu, Hi 96813

Phone 808.529.9990

Hilo Office

145 Keawe StHilo, HI 96720

Phone 808.529.9990

Office Hours

Monday - Friday8:00am - 5:00pm

Closed on Holidays