What Type of Entity Should Your Business Be?

05/10/2022

What Type of Entity Should Your Business Be?

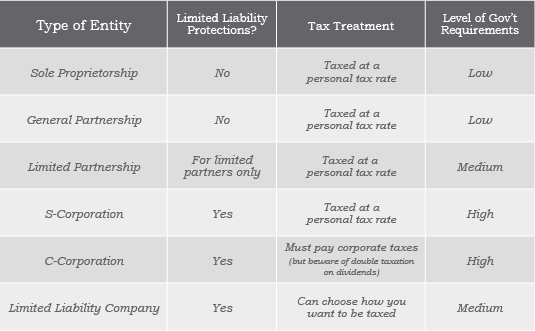

When determining which business form best suits the needs of the owners, many factors need to be considered. These include both tax and nontax factors. The goal in choosing a business form is to structure it so the form meets the taxpayers nontax objectives, while maximizing any current and future tax benefits.

Options to Consider:

Type of Entity — Tax Advantages VS. Disadvantages

Sole Proprietorship

Advantages

- One layer of taxation

- QBI deduction

- Filing simplicity—Schedule C is included with Form 1040

- Net income subject to self-employment (SE) tax

General & Limited Partnership

Advantages

- One layer of taxation

- QBI deduction

- Flexibility in allocation of income, gains, losses, and so on

- Distributive share of limited partners not subject to SE tax

- Partnership taxation is highly complex

- Distributive share of general partners subject to SE tax

S-Corporation

Advantages

- One layer of taxation

- QBI deduction

- Net income not subject to SE tax

- Strict qualification requirements: number of shareholders, type of shareholders, only one class of stock

- Profits must be allocated to shareholders based on percentage of ownership

C-Corporation

Advantages

- 21% flat tax rate

- Ability to deduct fringe benefits

- Double taxation

- Capital gain and loss treatment

- Net operating loss (NOL) can only be offset against corporate income

Limited Liability Company

Advantages

- Allowed to use default tax classification (disregarded entity or partnership) or elect to be taxed as a corporation (C or S)

- More exposure to SE tax if entity does not elect to be taxed as a corporation

Let HiAccounting help you navigate this important decision!

Liability protection, tax reporting, and government compliance are all key pillars of your business foundation. HiAccounting can help make sure these pillars are strategically aligned with the needs of your business and its owners. With a solid foundation, you and your business will be able to focus on the operations of the industry you know inside-and-out. Leave the taxes to us!

Give our Tax Experts a call at 808.529.9990.

Get In Touch

HiAccounting would be pleased to get in touch to discuss your accounting needs.

By submitting this form and signing up for texts, you consent to receive text messages from HiAccounting at the number provided. Msg data rates may apply. You can opt-out at any time.

Locations

Maui Office

24 N Church StreetWailuku, HI 96793

Phone 808.356.4357

Oahu Office

700 Bishop St. Suite 600Honolulu, Hi 96813

Phone 808.529.9990

Hilo Office

145 Keawe StHilo, HI 96720

Phone 808.529.9990

Office Hours

Monday - Friday8:00am - 5:00pm

Closed on Holidays